car sales tax in fulton county ga

Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. Georgia collects a 4 state sales tax rate on the purchase of all vehicles.

Fulton County Transportation Efforts To Continue Voters Extended Sales Tax Saportareport

Because Clayton County first levied the 1.

. You may visit a kiosks inside one of the following locations. Has impacted many state nexus laws and. If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166.

Heres how Fulton Countys maximum sales tax rate of 85 compares to other counties around the United States. In addition to taxes car purchases in Georgia may be subject to other fees like registration title and plate fees. 7 of the vehicles Fair Market Value.

Download all Georgia sales tax rates by zip code. Title Ad Valorem Tax TAVT became effective on March 1 2013. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc.

The 2018 United States Supreme Court decision in South Dakota v. For TDDTTY or Georgia Relay Access. As a result the total Fulton County sales tax rate outside the City of Atlanta changed from 7 percent to 775 percent beginning April 1 2017 -- the start date for the Fulton TSPLOST collection.

Fulton County GA Sales Tax Rate. The December 2020 total local sales tax rate was also 7750. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day.

The latest sales tax rates for cities in Georgia GA state. The current total local sales tax rate in Fulton County GA is 7750. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

There is also a local tax of between 2 and 3. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. This calculator can estimate the tax due when you buy a vehicle.

For example imagine you are purchasing a vehicle for 45000 but the fair market value is 40000. Tax title and license fees charged when purchasing a vehicle in Georgia are. TAVT is a one-time tax that is paid at the time the vehicle is titled.

There will be NO tax Sale for May 2022. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. Sales Tax States shows that the lowest tax rate in Georgia is found in Austell and is 4.

The Fulton County sales tax rate is. A county-wide sales tax rate of 26 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. The Atlanta sales tax rate is 89 Taxing Jurisdiction Rate Georgia state sales tax 400 Fulton County sales tax 300 Atlanta tax 150 Special tax 040.

Registration renewals at the kiosks have no additional charges for Fulton County residents. The 1 MOST does not apply to sales of motor vehicles. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those.

It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership. You can calculate the Title Ad Valorem Tax by finding the fair market value of the vehicle and multiplying it by 66. Click here for the March 2022 Tax Sale List.

Some cities and local governments in Fulton County collect additional local sales taxes which can be as high as 19. Fultons rate inside Atlanta is 3. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate.

You can find these fees further down on the page. You would pay 66 on the 40000 amount not the 45000 you paid. Kroger 3330 Piedmont Road NE Atlanta GA 30305.

The Fulton County Sheriffs Office month of November 2019 tax sales. You would also pay any applicable county or city car taxes. There will be NO tax Sale for May 2022.

How much is sales tax on a car in Georgia. In Clayton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. Taxes vary based on the cars value.

Help us make this site better by reporting errors. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. Always consult your local government tax offices for the latest official city county and state tax rates.

This tax is based on the value of the vehicle. Other possible tax rates in Georgia include. Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle.

Rates include state. Do Georgia vehicle taxes apply to trade-ins and rebates. Kroger 2685 Metropolitan Parkway SW Atlanta GA 30315.

Instead residents pay an ad velorum tax at the point of registration and must pay this tax annually for renewal according to CarsDirect. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. When purchasing a vehicle within the state of Georgia you do not actually pay the 4 percent retail sales tax.

Kroger 227 Sandy Springs Place Sandy Springs GA 30328.

Georgia Sales Tax Guide And Calculator 2022 Taxjar

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

Oc Effective Sales Tax Rates In Georgia R Atlanta

Sales Tax On Cars And Vehicles In Georgia

Georgia Used Car Sales Tax Fees

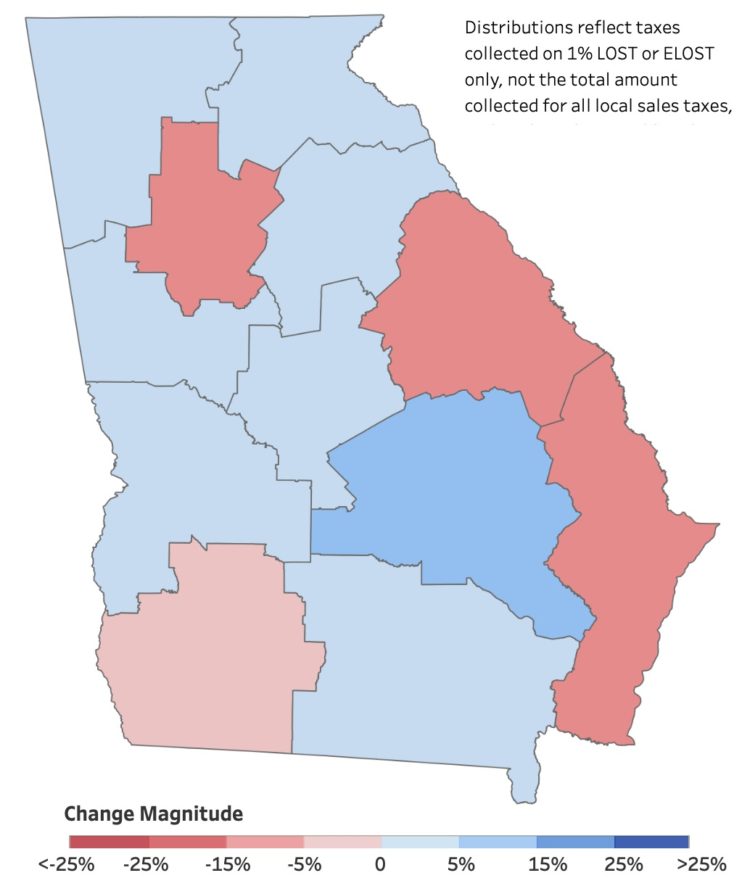

Sales Tax Collections Plummet At Least 15 In Metro Atlanta In June New Gsu Research Tool Saportareport

Georgia Sales Tax Guide For Businesses

Car Sales Tax In New York Getjerry Com

Car Sales Tax In Nevada Getjerry Com

Georgia S Internet Retail Tax Takes Effect Jan 1

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Sales Tax Impact Is Murky For Normal As Rivian Sales Begin Wglt

Georgia Sales Tax Small Business Guide Truic

![]()

Georgia New Car Sales Tax Calculator

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Sales Taxes In The United States Wikiwand

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Office Gomez Golomb Llc